rhode island income tax rate 2021

Rhode Island Income Tax Calculator 2021 If you make 202000 a year living in the region of Rhode Island USA you will be taxed 50225. No Tax Knowledge Needed.

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Find your pretax deductions including 401K flexible account contributions.

. 3 rows Rhode Island state income tax rate table for the 2020 - 2021 filing season has three. If you were subject to backup withholding on the sale of real estate in Rhode Island be sure to list the amount of withholding paid on your behalf on line 17c. This tax break applies on a per-person basis meaning that if a married couple files a joint return up to 15000 per spouse could be exempt from Rhode Island tax.

Tax Rate 0. Line 8a and 8b - Rhode Island Total TaxFee. This form is for income earned in tax year 2021 with tax returns due in April 2022We will update this page with a new version of the form for 2023 as soon as it is made available by the Rhode Island government.

The income tax is progressive tax with rates ranging from 375 up to 599. Find your income exemptions. 3 rows 2021 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA.

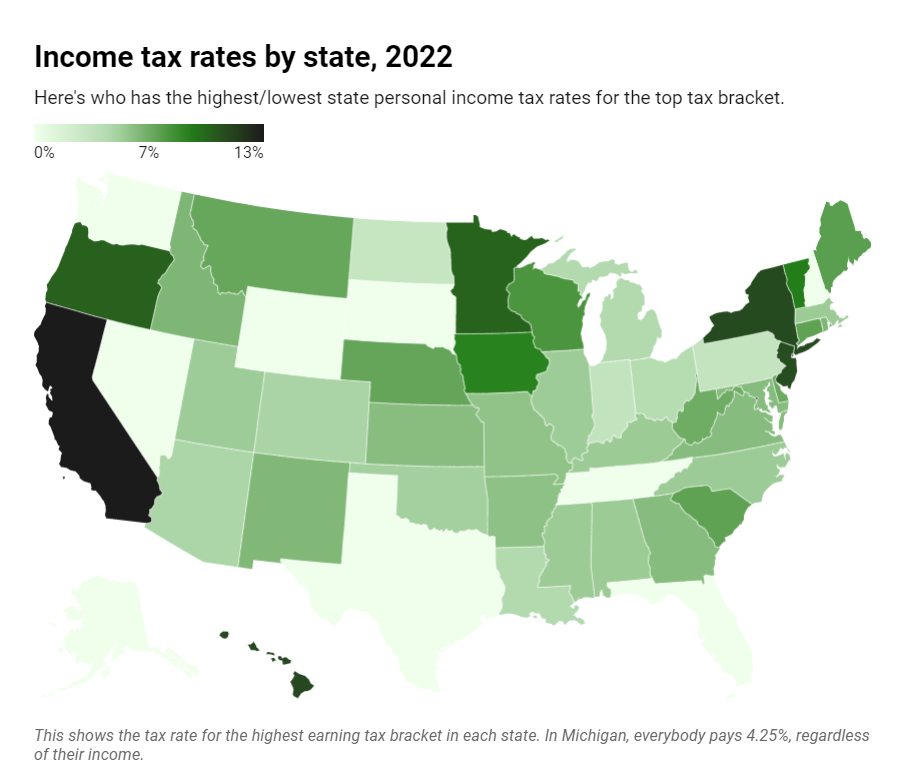

The Rhode Island estate tax has rates that range from 08 up to 16. How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table. Rhode Island Tax Brackets for Tax Year 2021 As you can see your income in Rhode Island is taxed at different rates within the given tax brackets.

Assuming for convenience a Rhode Island tax rate of 375 percent the break could. In gen-eral the Rhode Island income tax is based on your federal adjusted gross income. Wwwtaxrigov or call 401 574-8829 option 3.

Rhode Island has a flat corporate income tax rate of 7000 of gross income. Increased Federal AGI amounts for the social security the pension and annuity modifications. Uniform tax rate schedule for tax year 2021 personal income tax Taxable income.

Ad Answer Simple Questions About Your Life And We Do The Rest. Your average tax rate is. Any income over 150550 would be taxes at the highest rate of 599.

The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021. Providence Rhode Island 02903. Tax Rate Schedule RI Tax Tables NEW FOR 2021.

Complete your 2021 Federal Income Tax Return first. The federal corporate income tax by contrast has a marginal bracketed corporate income taxThere are a total of twenty four states with higher marginal corporate income tax rates then Rhode Island. Over But not over Pay percent on excess of the amount over 0 66200 -- 375 0 66200 150550 248250 475 66200 150550 -- 648913 599 150550.

RI-1040NR Nonresident Individual Income Tax Return wwwtaxrigov 2 0 2 1 Nonresident Real Estate Withholding. 2021 instructions for filing ri-1040c For more information on filing a Composite Return or to obtain forms refer to the Rhode Island Division of Taxations website. Find your gross income.

Line 7a - Rhode Island Annual Fee Enter the amount of 40000 on this line. The Rhode Island income tax has three tax brackets with a maximum marginal income tax. TurboTax Makes It Easy To Get Your Taxes Done Right.

It is the basis for preparing your Rhode Island income tax return. Nonresidents and part-year residents will file their Rhode Island Individual Income Tax Returns using Form RI-1040NR. We last updated Rhode Island Form RI-1041 Worksheet in March 2022 from the Rhode Island Division of Taxation.

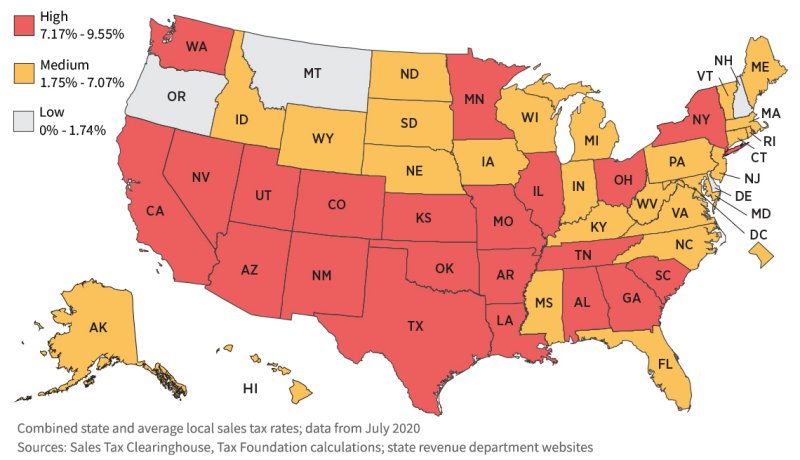

Those under 65 who are not disabled do not qualify for the credit. Check the 2021 Rhode Island state tax rate and the rules to calculate state income tax. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax.

RI-1040H 2021 2021 RI-1040H Rhode Island Property Tax Relief Claim PDF file about 2 mb megabytes RI-1040MU 2021 Credit for Taxes Paid to Other State multiple PDF file less than 1 mb megabytes RI-1040NR 2021 Nonresident Individual Income. RI-1041 line 8 TAX 2650 13128 2650 Over But not over 2650 8450 Over 8450 375 475 599 These schedules are to be used by calendar year 2021 taxpayers or fiscal year taxpayers that have a year beginning in 2021. Uniform tax rate schedule for tax year 2021 personal income tax Taxable income.

RI-1041 TAX COMPUTATION WORKSHEET 2021 BANKRUPTCY ESTATES use this schedule If Taxable Income- RI-1041 line. Over But not over Pay percent on excess of the amount over 0 66200 -- 375. This could provide a modification for a combined total of up to 30000 for that couple.

By contrast the federal exemption is 117 million for 2021 and 1206 million for 2022. Specifically the Rhode Island estate tax has an exemption of 1595156 for those who die in 2021 and 1648611 for anyone who dies in 2022. For tax year 2021 the property tax relief credit amount increases to 415 from 400.

Pursuant to RIGL 44-11-2e the minimum tax imposed shall be 40000 Line 7b - Jobs Growth Tax Enter 5 of the aggregate performance-based compensation paid to eligible employees as per the Jobs Growth Act 42-6411-5.

Rhode Island Income Tax Calculator Smartasset

The Least Tax Friendly State In America Income Tax States In America Income

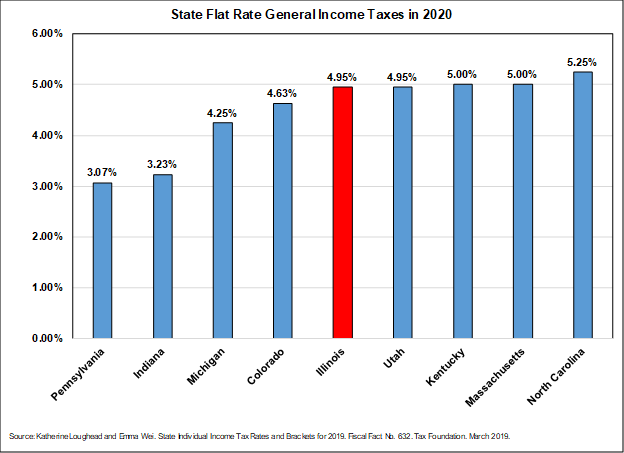

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

States With Highest And Lowest Sales Tax Rates

Monday Map Top State Income Tax Rates Tax Foundation

Corporate Tax In The United States Wikiwand

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

2022 Income Tax Brackets And Standard Deduction

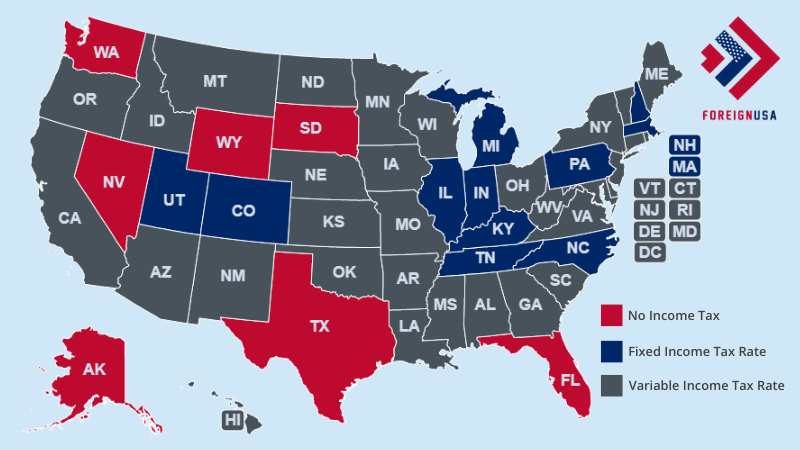

State Income Tax Rates Highest Lowest 2021 Changes

2022 State Income Tax Rankings Tax Foundation

Individual Income Tax Structures In Selected States The Civic Federation

How High Are Capital Gains Taxes In Your State Tax Foundation

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Income Tax Tax Liability Deductions Video Lesson Transcript Study Com

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)